COVID-19 For Members

Everything You Need to Know About COVID-19 to Keep Your Company on the Road

Updated March 1, 2022 at 9:00am

FMCSA Announces Extensions of the COVID-19 Emergency Waivers and Declarations

FMCSA announced extensions of some COVID-19 Emergency Waivers and Declarations that were set to expire at the end of February.

EMERGENCY DECLARATION

FMCSA’s Emergency Declaration that was set to expire on February 28th has been extended until May 31, 2022.

The declaration extended yesterday is limited to the transportation of:

- Livestock and livestock feed;

- Medical supplies and equipment related to the testing, diagnosis, and treatment of COVID-19;

- Vaccines, constituent products, and medical supplies and equipment, including ancillary supplies/kits for the administration of vaccines, related to the prevention of COVID-19;

- Supplies and equipment necessary for community safety, sanitation, and prevention of community transmission of COVID-19 such as masks, gloves, hand sanitizer, soap, and disinfectants;

- Food, paper products, and other groceries for emergency restocking of distribution centers or stores;

- Gasoline, diesel, jet fuel, and ethyl alcohol; and,

- Supplies to assist individuals impacted by the consequences of the COVID-19 pandemic (e.g., building materials for individuals displaced or otherwise impacted as a result of the emergency).

As with the previous extension, this declaration applies only to 395.3 “Maximum Driving Time for Property-Carrying Vehicles”. This declaration becomes effective at 12:00 a.m. March 1, 2022 and expires May 31, 2022 unless modified or terminated sooner. Reporting requirements previously established remain in effect. To be eligible, the transportation must be both (1) of qualifying commodities and (2) incident to the immediate restoration of those essential supplies. We strongly encourage everyone to review the applicability, restrictions, and limitations listed within the waiver.

CDL/CLP/MEDICAL EXAMINATION ENFORCEMENT DISCRETION

FMCSA has issued a notice of enforcement policy/discretion regarding CDL/CLPs and Medical Examinations. FMCSA will exercise its enforcement discretion to not take enforcement action for a CLP or CDL holder operating a CMV with an expired license, but only if the CLP or CDL was valid on February 29, 2020 and expired on or after March 1, 2020. FMCSA will also exercise enforcement discretion for CMV drivers whose medial certification or medical variance expired on or after December 1, 2021. Drivers whose medical certification or medical variance expired before December 1, 2021 are not covered by this notice of enforcement policy.

This notice is effective March 1, 2022 and expires on April 15, 2022.

ADDITIONAL NOTICES AND RESOURCES

FMCSA has extended existing waivers related to CLP holders, out of state skills testing, and the 14 day waiting period here. Additional resources, including frequently asked questions can be found here.

FMCSA Announces Several Extensions of the COVID-19 Emergency Waivers and Declarations

This morning, FMCSA announced several extensions of the COVID-19 Emergency Waivers and Declarations.

EMERGENCY DECLARATION

FMCSA’s Emergency Declaration that was set to expire on November 30th has been extended until February 28, 2022.

The declaration published today is limited to the transportation of:

- Livestock and livestock feed;

- Medical supplies and equipment related to the testing, diagnosis, and treatment of COVID-19;

- Vaccines, constituent products, and medical supplies and equipment, including ancillary supplies/kits for the administration of vaccines, related to the prevention of COVID-19;

- Supplies and equipment necessary for community safety, sanitation, and prevention of community transmission of COVID-19 such as masks, gloves, hand sanitizer, soap, and disinfectants; and,

- Food, paper products, and other groceries for emergency restocking of distribution centers or stores;

- Gasoline, diesel, jet fuel, and ethyl alcohol; and,

- Supplies to assist individuals impacted by the consequences of the COVID-19 pandemic (e.g., building materials for individuals displaced or otherwise impacted as a result of the emergency).

This declaration applies only to 395.3 “Maximum Driving Time for Property-Carrying Vehicles”. This declaration becomes effective at 12:00 a.m. December 1, 2021 and expires February 28, 2022 unless modified or terminated sooner. Reporting requirements previously established remain in effect. To be eligible, the transportation must be both (1) of qualifying commodities and (2) incident to the immediate restoration of those essential supplies. We strongly encourage everyone to review the applicability, restrictions, and limitations listed within the waiver.

CDL/CLP/MEDICAL EXAMINATION EXTENSIONS

FMCSA has extended the CDL and CLP waivers under certain circumstances. Details on the applicability can be found here. Please note, this waiver permits, but does not require,States to extend the validity of commercial driver’s licenses (CDLs) and commercial learner’s permits (CLP) for those issued on or after March 1, 2020, until February 28, 2022. Carriers and drivers should check with their state agencies to ensure compliance, as not all states may extend the validity period.

For medical examinations, this waiver waives, until February 28, 2022, the requirement that drivers have a medical examination and certification, provided they have proof of a valid medical certification and any required medical variance issued for a period of 90 days or longer and expired on or after September 1, 2021. Additional terms, conditions, and restrictions are outlined in the waiver.

THIRD-PARTY CDL TESTING AND CLP HOLDERS

Additionally, FMCSA has extended waivers related to third-party CDL skills test examiners, and CLP holders operating a CMV.

Additional resources, including frequently asked questions can be found here. FMCSA has indicated they intend to review the status of certain waivers as of January 3, 2022 and may take action to terminate the waivers sooner if conditions warrant.

American Trucking Associations Issues Statement on COVID-19 Vaccine Mandate

On October 21, 2021, Chris Spear, President & CEO at the American Trucking Associations, issued the following letter regarding the COVID-19 vaccine mandate and provided a toolkit to help address frequently asked questions:

|

Dear ATA Member: I wanted to update you on the latest developments regarding the Administration’s vaccine mandate proposal, as well provide relevant resources to help your companies navigate this issue. Since OSHA sent its proposed rule—which has not yet been made public—to the White House on October 12, we have been in constant communication with Administration officials to convey our serious concerns over the impact such a policy will have on the trucking industry and our ability to keep the nation’s supply lines moving. This evening, we submitted official comments to the Office of Information and Regulatory Affairs—the White House office responsible for reviewing the draft Emergency Temporary Standard before it can go into effect. Our letter formally requests that the Administration:

Thanks to data provided by ATA members, we have detailed the grave consequences that a misguided rule would have on our nation’s supply chain, which is already under enormous strain. We have made clear that our industry can ill-afford further disruptions as we carry out the vital work of delivering vaccines, PPE, medical supplies, food, water, gasoline, and other essential goods. It bears repeating that no rule—draft or otherwise—has been made public to date. Although we hope the Administration heeds our concerns, we are prepared to respond to every possible outcome, with all options on the table, including potential legal action if necessary. In the meantime, we have prepared this toolkit, including frequently asked questions, to help you and your employees better understand what is undoubtedly a complex topic and complicated rulemaking process. We will keep you updated with additional developments. Best, Chris |

Frequently Asked Questions Relating to FMCSA Emergency Declaration - October 19, 2021

The FAQs relating to the COVID-19 emergency declaration have been updated, adding some new questions and eliminating questions that are no longer applicable. They can be found at the link below.

https://www.fmcsa.dot.gov/emergency/frequently-asked-questions-relating-fmcsa-emergency-declaration-october-19-2021

Note: This guidance document does not have the force and effect of law and is not meant to bind the public in any way. This guidance is intended only to provide clarity regarding existing requirements under the law.

FMCSA Announces New Extensions of CDL, CLP, and Medical Certificate Waivers until May 31, 2021

On Tuesday, February 16, the Federal Motor Carrier Safety Administration (FMCSA) announced it will extend the waiver for drivers to renew their expired CDL’s, CLP’s, and medical certificates until May 31, 2021. The initial declaration was issued March 13, 2020 and has been renewed several times since, as the COVID-19 pandemic forced many state licensing facilities to close, or to operate at a greatly reduced capacity, due to stay-at-home and social distancing requirements. The current waiver was slated to expire on February 28.

A key adjustment in the wording of the latest extension is that states are permitted, but NOT required, to extend the validity of expired CDL’s, CLP’s, and medical certificates beyond the current waiver expiration date of February 28.

In posting the waiver, FMCSA cited that the extension was needed due to the potential backlogs that exist at various State Driver’s License Agencies (SDLA) and Motor Vehicle Bureaus across the country. In addition, the Agency noted the pace of return to normal operations across the country varies greatly from state-to-state, despite the arrival and distribution of the first COVID-19 vaccines.

The waiver applies to all Commercial Driver’s Licenses (CDL’s) and Commercial Learner’s Permits (CLP’s) issued on or after March 1, 2020. The CLP waiver means that drivers will not have to retake the general and endorsement knowledge tests again, when they present their CLP for renewal. The order also waives the requirement that CLP holders must wait 14 days to take the CDL skills test.

Medical certificates issued on after December 1, 2020, including those with required medical variances, issued for a minimum of 90 days, will continue to be accepted until May 31, 2021. The waiver also affects the requirement of CDL and CLP holders to provide a state License Agency an original or copy of the medical examiner’s certificate, provided the CDL/CLP holder has proof of a valid medical certification or variance that expired on or after December 1, 2020.

In Ohio, Governor Mike DeWine had previously signed House Bill 404, which included a provision to extend the expiration dates of driver licenses and vehicle registrations. If the license or registration is due to expire anytime between March 9, 2020, and April 1, 2021, the license or registration will remain valid until June 30, 2021.

IRS Lists Alternatives to Heavy Truck Owners Waiting on Stamped 2290 Forms for Registration

Due to the volume and staffing issues created by the COVID-19 pandemic, heavy truck owners who filed a paper Form 2290 to report and pay the highway use tax for the taxable period July 1, 2020, through June 30, 2021, have been noticing significant delays in receiving their IRS-stamped Form 2290 Schedule 1 receipt. This receipt is required documentation to renew a truck registration at the state Bureau of Motor Vehicles (BMV).

With the end of the year fast approaching, the IRS has provided guidance on how to get a registration renewed for vehicles in which the 2290 tax has been paid, but the stamped 2290 document has not yet been returned to the truck owner as proof of payment.

According to the IRS guidance, a state must accept as proof of payment a photocopy of the Form 2290 (with the Schedule 1 attached) that was filed with the IRS for the vehicle being registered, along with sufficient documentation that the taxpayer paid the tax due at the time the Form 2290 was filed. This documentation may consist of:

(i) if a taxpayer has paid by paper check, a photocopy of both sides of a cancelled check;

(ii) if a taxpayer has paid using the Electronic Federal Tax Payment System, a copy of the acknowledgment of payment; or

(iii) if the taxpayer has paid using an Electronic Funds Withdrawal, a copy of the taxpayer’s monthly bank statement indicating “IRS USA Tax Payment,” “IRS USA Tax Pymt,” or similar language.

It is strongly recommended to confirm with the IRS that payment has been received through one of these methods, before going to the BMV to complete the registration of the heavy truck.

Ohio, FMCSA Announces New Extensions of CDL, CLP, and Medical Certificate Waivers into 2021

On Thursday, December 17, the Federal Motor Carrier Safety Administration (FMCSA) announced it will extend the waiver for drivers to renew their expired CDL’s, CLP’s, and medical certificates until February 28, 2021. The initial declaration was issued March 24, and has been renewed several times since, as the COVID-19 pandemic forced many state licensing facilities to close. The current waiver was slated to expire on December 31.

In posting the waiver, FMCSA cited that the extension was needed due to the potential backlogs that exist at various State Driver’s License Agencies (SDLA) and Motor Vehicle Bureaus across the country. In addition, the Agency noted a resurgence of stay-at-home orders and other emergency measures that may cause further economic and logistical disruptions, despite the arrival and initial distribution of the first COVID-19 vaccines.

The waiver applies to all Commercial Driver’s Licenses (CDL’s) and Commercial Learner’s Permits (CLP’s) issued on or after March 1, 2020. The CLP waiver means that drivers will not have to retake the general and endorsement knowledge tests again, when they present their CLP for renewal. The order also waives the requirement that CLP holders must wait 14 days to take the CDL skills test.

Medical certificates issued on after September 1, 2020, including those with required medical variances, issued for a minimum of 90 days, will continue to be accepted until February 28, 2021. The waiver also affects the requirement of CDL and CLP holders to provide a state License Agency an original or copy of the medical examiner’s certificate, provided the CDL/CLP holder has proof of a valid medical certification or variance that expired on or after September 1, 2020.

In Ohio, Governor Mike DeWine had previously signed House Bill 404, which included a provision to extend the expiration dates of driver licenses and vehicle registrations. If the license or registration is due to expire anytime between March 9, 2020, and April 1, 2021, the license or registration will remain valid until July 1, 2021.

New HOS Rules Take Effect Tuesday September 29, 2020

The Federal Motor Carrier Safety Administration’s new Hours of Service (HOS) rules go into effect at one midnight past midnight, Eastern Time, Tuesday, September 29. The new rules include the expansion of split-sleeper berth options afforded to drivers, which will allow them to split their 10-hour off-duty period into windows of seven hours and three hours, in addition to the existing eight-hour, two-hour option. The shorter window in any split of off-duty time will not count against a drivers’ 14-hour on-duty clock.

Provisions around the 30-minute break requirement have been changed, allowing drivers the additional option of logging their break as on-duty, not-driving, as well as off-duty or sleeper berth. The requirement covering when to take the break has also been adjusted, to allow the driver to take it within their first eight hours of drive time, rather than their first eight hours on-duty.

Another rule change will expand the adverse driving conditions provision by allowing drivers to extend both their drive-time limit and their on-duty window by two hours if they encounter adverse conditions such as weather or traffic congestion. The agency says the provision will allow drivers to either sit and wait out the conditions or to drive slowly through them.

Short-haul carriers will get benefits from the final rule change, which expands the exemptions for short-haul drivers by extending their allowed on-duty period from 12 hours to 14 hours. Drivers under the short-haul exemption aren’t required to keep records of duty status, and do not need to take the mandatory 30-minute break after eight hours of driving. Finally, the radius for short haul exemption status has been increased from 100 to 150 air miles.

FMCSA Extends Emergency Relief Declaration to Sept. 14

The Federal Motor Carrier Safety Administration has again extended its emergency declaration relaxing hours-of-service rules for motor carriers that are providing direct assistance in support of coronavirus-related relief efforts. CLICK HERE to learn more.

FMCSA Extends Emergency Relief Declaration to Aug. 14

The Federal Motor Carrier Safety Administration again extended its emergency relief declaration for truckers directly assisting with coronavirus-related efforts.

FMCSA on July 13 announced the declaration will remain in place through Aug. 14. The agency explained the extension is necessary to continue aid efforts across certain supply chains.

Specifically, according to the notice, the extension offers “regulatory relief for commercial motor vehicle operations providing direct assistance in support of emergency relief efforts related to COVID-19 and is limited to transportation of livestock and livestock feed; medical supplies and equipment related to the testing, diagnosis and treatment of COVID-19; and supplies and equipment necessary for community safety, sanitation, and prevention of community transmission of COVID-19 such as masks, gloves, hand sanitizer, soap and disinfectants.”

The emergency declaration, which had been set to expire July 14, covers every state and the District of Columbia. It keeps the exemption from Parts 390-399 of the Federal Motor Carrier Safety Regulations. Those sections pertain to hours of service, parts and accessories needed for safe operation, and longer combination vehicles.

The declaration, however, does not grant relief from speed limits, drug and alcohol regulations, or size and weight requirements. CLICK HERE to read the full declaration.

FMCSA Announces Extension of CDL, CLP, and Medical Cert Waiver

On Monday, June 15, the Federal Motor Carrier Safety Administration (FMCSA) announced it will extend the waiver for drivers to renew their expired CDL’s, CLP’s, and medical certificates until September 30. The initial declaration was issued March 24, as the COVID-19 pandemic forced many state licensing facilities to close, and was slated to expire on June 30.

The waiver applies to all Commercial Driver’s Licenses (CDL’s), Commercial Learner’s Permits (CLP’s), and medical certificates issued on or after March 1, 2020. The CLP waiver means that drivers will not have to retake the general and endorsement knowledge tests again, when they present their CLP for upgrade to a full CDL. CLICK HERE to read the full declaration.

Hours of Service - What's New in the Final Rule

On Thursday, June 11, OTA President & CEO Tom Balzer was joined by Julia Felts, Safety Investigator for Ohio FMCSA and Stephen McCormick, Division Administrator for the Ohio FMCSA Office as part of the OTA on the Air series. During this webinar, an overview of Hours of Service was discussed. CLICK HERE for the Hours of Service slides. CLICK HERE for the webinar recording.

FMCSA Extends the Emergency Declaration until July 14, 2020

The Federal Motor Carrier Safety Administration has extended the Emergency Declaration until July 14, 2020 with some changes.

The Federal Motor Carrier Safety Administration has extended the Emergency Declaration until July 14, 2020 with some changes.

Effective June 15, 2020, the following items or personnel are no longer eligible for the emergency exemption as of the end of the day on June 14, 2020:

- Food, paper products, and other groceries for emergency restocking of distribution centers or stores;

- Fuel;

- Liquefied gases to be used in refrigeration or cooling systems;

- Equipment, supplies, and persons necessary to establish and manage temporary housing, quarantine, and isolation facilities related to COVID- 19;

- Persons designated by federal, state or local authorities for medical, isolation, or quarantine purposes; and

- Persons necessary to provide other medical or emergency services.

CLICK HERE to read the full declaration.

FMCSA Announces Remote Carrier Audit Option During COVID-19

During the COVID-19 public health emergency, the Federal Motor Carrier Safety Administration (FMCSA) has announced it will conduct compliance reviews under 49 CFR part 385, subpart A, by leveraging all available technology to access information and records and thus limit exposure risk for the regulated community and safety investigators. Using the same standards otherwise applicable, FMCSA will assign safety ratings following a compliance review even if no on-site review activities have taken place. FMCSA will continue to apply the procedures in 49 CFR part 385, including the Safety Fitness Rating Methodology (SFRM) in Appendix B, prior to assigning a safety rating. This guidance does not apply to compliance reviews conducted under 49 CFR part 385, subpart B.

Since adoption of the SFRM in 1997, the mechanisms and tools FMCSA use to access information from motor carriers has continued to evolve, making compliance reviews more efficient and lessening the burden on the regulated community. Although the definition of “compliance review” in 49 CFR 385.3 describes these reviews as “on-site,” in practice, the advent of electronic recordkeeping and other technology now allows FMCSA to perform the same investigative functions remotely that it could perform previously only by in-person reviews of the motor carrier’s files.

Motor carriers may access and transmit their information through a portal directly with FMCSA and upload documents in a secure environment. Many motor carriers maintain their records electronically and prefer to submit the records directly, from the electronic application where they are stored. Motor carriers may also fax or email documents to FMCSA if they so choose, or if they cannot access the portal. FMCSA may also use email and telephone and video calls as a substitute for in-person interaction with motor carrier officials during the compliance review or to review the findings of the compliance review with company officials during the close out.

Because of travel restrictions, social distancing, and other advisories associated with the COVID- 19 public health emergency, and the desire to limit exposure risk to the regulated community and safety investigators, FMCSA will conduct compliance reviews of motor carriers and assign safety ratings even if those compliance reviews do not include an “on-site” component. FMCSA has determined that because safety investigators are able to follow all of the procedures in 49 CFR part 385 without physically visiting the motor carrier’s business premise, compliance reviews that do not include an “on-site” component will limit exposure risk to COVID-19, consistent with current regulations, without compromising FMCSA’s safety mission.

This guidance is effective immediately and shall remain in effect until the COVID-19 National Emergency Declaration is lifted.

Paycheck Protection Program Loan Forgiveness Application

To apply for forgiveness of your Paycheck Protection Program (PPP) loan, you (the Borrower) must complete this application as directed in these instructions, and submit it to your Lender (or the Lender that is servicing your loan). Borrowers may also complete this application electronically through their Lender. CLICK HERE to download the application.

FMCSA Announces Extension of Hours-of-Service Exemption for Emergency Relief Shipments through June 14

The Federal Motor Carrier Safety Administration (FMCSA) has announced an extension of the regulatory relief from the Hours of Service (HOS) requirements for commercial motor vehicle carriers providing direct assistance in support of transport of emergency relief supplies, including community safety and emergency restocking items, as well as medical equipment and testing supplies. This exemption declaration, which was due to expire on May 15, is now in effect until June 14.

The Declaration continues to mandate that in order to meet the criteria for the exemption, the shipment must consist of the following:

- medical supplies and equipment related to the testing, diagnosis and treatment of COVID-19;

- supplies and equipment necessary for community safety, sanitation, and prevention of community transmission of COVID-19 such as masks, gloves, hand sanitizer, soap and disinfectants;

- food for emergency restocking of stores;

- equipment, supplies and persons necessary to establish and manage temporary housing, quarantine, and isolation facilities related to COVID-19;

- persons designated by Federal, State or local authorities for medical, isolation, or quarantine purposes; and

- persons necessary to provide other medical or emergency services, the supply of which may be affected by the COVID-19 response.

Shipments of all other items, including mixed loads that may contain some of the items listed above, are NOT exempt from the granting of regulatory relief.

This Declaration applies to drivers while they are delivering shipments described above, as well as the time they are returning empty from a delivery of the items described above, to their normal terminal or work reporting location.

Motor carriers should be aware that this notice does not absolve them of their duty to monitor their drivers. In addition, this granting of relief is not an exemption from driver’s CDL requirements; controlled substance and alcohol use and testing requirements; hazmat, size, and weight requirements; or financial responsibility (insurance) requirements.

Inquiries to the FMCSA regarding this Declaration can be made to this toll-free number: (877) 831-2250.

CLICK HERE for a copy of the extension.

PPP Deadline Extended; Discussions on PPP Expansion in DC

The Small Business Administration has announced that the deadline for applying for the Paycheck Protection Program has been extended from May 7 to May 14. If you still want to apply for the PPP, please contact your local SBA-approved lender.

In addition, lawmakers in Washington, DC are discussing future expansions of the PPP as the House and Senate are working on the next stimulus package. The House is expected to unveil plans as early as Friday. Stay tuned.

Ohio BMV Adds Online Commercial Truck and Trailer Renewal Option

The Ohio Bureau of Motor Vehicles (BMV) has announced additional options to their online registration service, OPLATES. Effective immediately, certain non-IRP apportioned Commercial Truck and Trailer registration renewals can be completed and paid for online.

This first addition to the OPLATES online service allows registrants to renew and pay their commercial vehicle class TK and TL registrations for 1 to 5 years, and are limited to those that do not result in new plate issuance as follows:

- Renewals for Commercial Trailers (TL);

- Renewals for Commercial Trucks (TK) restricted to vehicles with GVW under 55,000 lbs;

- Replacements of Registration Card and/or Validation Stickers

In order to begin the process, the commercial Registrant will need to access the OPLATES system at www.oplates.com. Once there, select the box titled Ohio Plates. Use the first query option (Plate Information). This Plate Information query requires the TIN (Federal Taxpayer Identification Number) used for registration, and a Plate Number that they wish to renew. The user will then follow the instructions on the screen to complete the commercial renewal transaction and add it to their cart for online payment. This process can be repeated for up to 15 plates under a single payment via credit card or E-Check. After that, the process can be repeated for an additional 15 plates, etc.

Validation stickers and Registration Cards will be sent via mail in the timeframe provided at the time of payment. Any questions or requests for assistance with the OPLATES program should be directed to the Office of Vehicle Services, at (844) 644-6268, or through the Live Chat link at www.bmv.ohio.gov.

Ohio Issues "Stay Safe Ohio Order"

‘Stay Safe Ohio’ order extends some stay-at-home protocol until May 29, with exceptions for reopening. CLICK HERE to read the full order.

PPE Resources

Hand Sanitizer

Middle West Spirits in Columbus is providing hand sanitizer ranging from 8oz bottles to a 5 gallon bucket with spout. The 5 gallon buckets are $0.25 an ounce. To order please do so directly use this form.

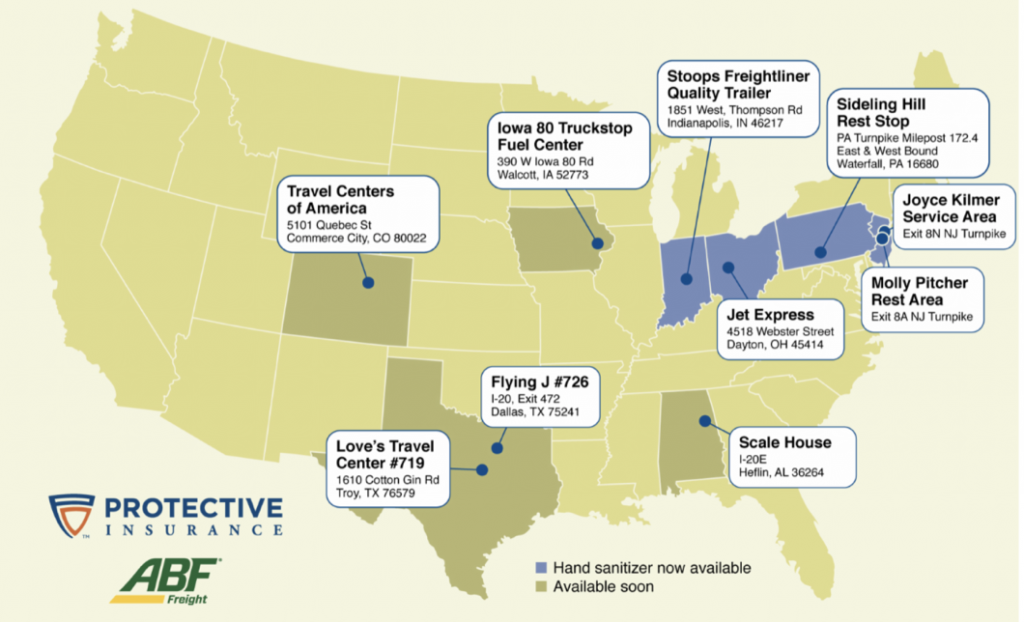

Drivers are also able to stop at Jet Express in Dayton to fill up their personal supply of hand sanitizer. Jet Express is located at 4518 Webster Street, Dayton, OH, 45414.

Disposable Masks

If you are looking for FDA Certified Medical 3-Layer Disposable Masks, they are available through Aunt Flow, a Columbus based company. Prices are as low as $0.96 each. Please order by following this link.

Cloth Masks

Delta Apparel, a Hebron based company, has non-medical grade cloth face masks available for as low as $1.15 per mask. CLICK HERE for more information and ordering information.

BWC Board approves $1.6 billion dividend for Ohio employers

The Ohio Bureau of Workers' Compensation’s Board of Directors approved to send up to $1.6 billion to Ohio employers this spring to ease the economic impact of the coronavirus (COVID-19) pandemic on Ohio’s economy and business community. This action comes in response to Ohio Governor Mike DeWine’s call for state agencies to do all they can to help the state’s business community withstand COVID-19’s challenges, which include temporary business closings, stay-at-home orders, and a record number of Ohioans applying for unemployment assistance. CLICK HERE for a FAQ Document on the dividend. CLICK HERE for a general FAQ on BWC and COVID-19.

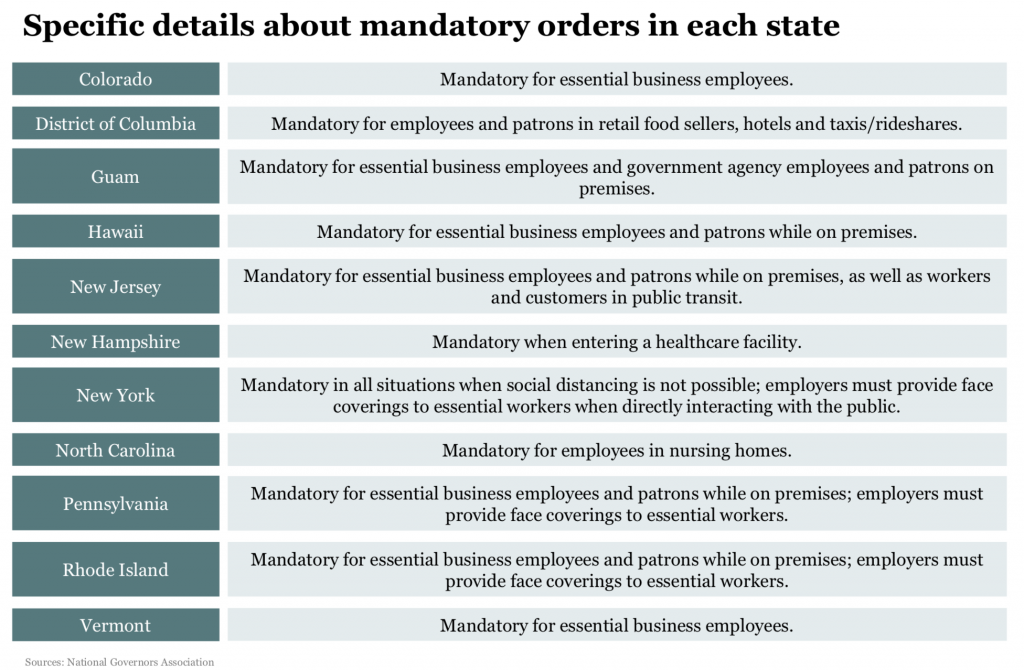

Coronavirus – Facial Covering Orders

CLICK HERE for an overview of state orders regarding the use of facial covers while in public from NationalJournal.

CLICK HERE for an overview of state orders regarding the use of facial covers while in public from NationalJournal.

OTA Members Support ATA Distribution of Hand Sanitizer

As professional truck drivers continue serving on the frontlines during the COVID-19 crisis, American Trucking Associations has partnered with Protective Insurance Company to expand the availability and supply of hand sanitizer to truckers along major U.S. freight corridors. ATA and member-company ABF Freight are hauling ten 55-gallon drums of hand sanitizer, purchased by Protective Insurance, for distribution in eight states, where drivers will be able to refill their personal supplies at no cost.

As professional truck drivers continue serving on the frontlines during the COVID-19 crisis, American Trucking Associations has partnered with Protective Insurance Company to expand the availability and supply of hand sanitizer to truckers along major U.S. freight corridors. ATA and member-company ABF Freight are hauling ten 55-gallon drums of hand sanitizer, purchased by Protective Insurance, for distribution in eight states, where drivers will be able to refill their personal supplies at no cost.

Ohio BMV Clarifies CDL Hazmat Renewal Process During COVID-19

The continued social distancing requirements and facility closures stemming from the COVID-19 pandemic has caused some confusion and uncertainty in one key area: the process for renewing a hazardous materials (hazmat) endorsement on a Commercial Driver’s License (CDL), which includes the successful completion of a Security Threat Assessment (STA) from the Transportation Security Administration (TSA).

After reaching out to the Ohio Bureau of Motor Vehicles (BMV) for clarification, the following guidance is in place for Ohio CDL drivers with a hazmat endorsement:

- Any CDL, with any endorsements added, that expired after March 9, 2020, and haven’t been renewed, are still considered valid. No enforcement of a CDL that expired after March 9 is taking place at this time.

- The BMV is advising drivers with a hazmat endorsement NOT to renew their CDL until they can successfully complete the STA requirement.

- Drivers looking to renew their CDL, including their hazmat endorsement, need to start an STA at least 60 days before they go to one of the five open BMV deputy registrar offices in Ohio to get their CDL renewed. At this time, eight TSA enrollment centers are open for this purpose: one each in Columbus, Dayton, Cincinnati, and Toledo (Sylvania), along with four in NE Ohio—Ashtabula, Fairlawn, Middleburg Heights, and Parma.

This policy will remain in place until 90 days after the lifting of the Emergency declaration, or December 1, 2020, whichever comes first.

Special COVID-19 Coverage Brought to You By Our Sponsors:

![]()

![]()

![]()

Friends of OTA:

Marsh & McLennan Agency

J.J. Keller & Associates

Truck Renting & Leasing Association

No Extension of IFTA Filing Deadline

What do I do after I receive my Paycheck Protection Program (PPP) Funds?

Ohio Trucking Association sponsor Schneider Downs has authored a timely article about what to do after you receive your Paycheck Protect Program funds, what they can be spent on and how to track those expenditures properly. As you recall, when applying for this loan, there is an opportunity to have 100% of the loan forgiven and, unlike other loans, having this loan forgiven will not be taxed for federal income tax purposes. The states are still considering the impact of the loan forgiveness, but you still need to focus on maximizing the forgiveness offered. CLICK HERE for the full article.

Ohio Trucking Association sponsor Schneider Downs has authored a timely article about what to do after you receive your Paycheck Protect Program funds, what they can be spent on and how to track those expenditures properly. As you recall, when applying for this loan, there is an opportunity to have 100% of the loan forgiven and, unlike other loans, having this loan forgiven will not be taxed for federal income tax purposes. The states are still considering the impact of the loan forgiveness, but you still need to focus on maximizing the forgiveness offered. CLICK HERE for the full article.

TSA extends renewal time for TWIC cards to July 31, 2020

The Transportation Security Administration (TSA) has granted a temporary exemption for the expiration of Transportation Worker Identification Credentials (TWIC) through July 31, 2020 for cards that expired after March 1, due to continued gathering restrictions and facility closures stemming from the COVID-19 nationwide emergency.

The exemption became effective April 10.

“During this time, it is vital to move cargo expeditiously through the supply chain, and to ensure that medical supplies and home goods reach health care centers and consumers,” said the TSA announcement.

TSA regulations require truck drivers and other transportation workers who seek unescorted access to secured areas of maritime port facilities to undergo a security threat assessment conducted by the agency to receive a TWIC.

A TWIC expires five years from the date of issuance, and individuals must go to a TSA enrollment center to initiate a new security threat assessment to receive a new credential.

TWIC applicants also are required to provide proof of identity and fingerprints at approved enrollment sites, designated and operated by TSA trusted agents.

TSA records show that 234,536, or approximately 10% of the total number of TWICs issued, will expire in the next six months.

“Social distancing practices in response to the COVID-19 crisis make gathering at enrollment centers unwise or prohibited,” TSA said. Approximately one-third of TSA’s TWIC enrollment centers have been forced to close because they are collocated with commercial or government offices that are closed as a result of COVID-19. For those that are operating, the process of collecting fingerprints and completing the enrollment process “may introduce risk to enrollment center staff or TWIC applicants,” TSA said.

During the extension period, the agency said it will continue to recurrently vet exempted TWIC holders against federal terrorism and national security-related watch lists, and a Department of Homeland Security system for security threats, criminal history and immigration status checks.

Lt. Governor Husted announced that the Governor’s Office of Workforce Transformation has developed a website specifically geared toward matching essential businesses with Ohioans who are able and willing to work as an essential employee during the COVID-19 crisis. Click HERE to access the job search site.

Ohio's stay-at-home order will now run through the entire month of April at least – with additional limitations – after Gov. Mike DeWine announced an extension Thursday, April 2, 2020. The extension serves as a response to the continued growth of coronavirus cases in the state amid the ongoing pandemic. Full Order HERE.

We Appreciate You and Your Dedication to the Industry!

Three-Month FMCSA Waiver on CLP Holders Operating CMV’s

The Federal Motor Carrier Safety Administration (FMCSA) has issued a waiver for holders of Commercial Learner Permits (CLP), until June 30, 2020, or the lifting of the COVID-19 National Emergency Declaration, whichever comes first.

This waiver is limited in scope; with regards to the operation of a CMV, the waiver lifts the requirement that a CDL driver must be in the front passenger seat, next to the CLP driver, while the CLP holder is driving. The CDL holder may now be in the sleeper berth, allowing the team to function as would a team with two CDL drivers in the truck.

All other requirements for the CLP holder remain in place, including proof that the CLP holder has passed the CDL driving skills test, and carries a valid CLP, a non-CDL driver’s license, and medical certificate. NOTE: if any of the three documents listed expired after March 1, 2020, then the FMCSA waiver from March 24, extending the validity of these documents, also applies.

The other part of this waiver lifts the “same-state” training and testing requirement for non-domiciled CLP holders. States with facilities open for CDL skills tests, may administer the test to any non-domiciled CDL applicant, regardless of where the applicant received driver training.

The FMCSA restricted this waiver, so that it does NOT apply to any CMV operating under any shipment requiring any type of endorsement, including:

- T: Tandem (Double and Triple) Trailers

- P: Passenger

- N: Tank trailer

- H: Hazardous Materials

- X: Combination of Tank/Hazardous Materials

- S: School Bus

The complete waiver is available at this link: https://www.fmcsa.dot.gov/emergency/three-month-waiver-response-covid-19-emergency-states-and-clp-holders-operating

Latest FMCSA and DOT Information and Releases

- Three Month Waiver for States and CLP Holders Operating Commercial Vehicles

- Enforcement Notice on Expiring CDLs - Effective March 24

- DOT Guidance on Compliance with DOT Drug and Alcohol Testing Regulations

- Frequently Asked Questions Relating to FMCSA Declaration

- PHMSA Notice of Enforcement Policy Regarding Hazardous Materials Training

- FMCSA National Emergency Declaration

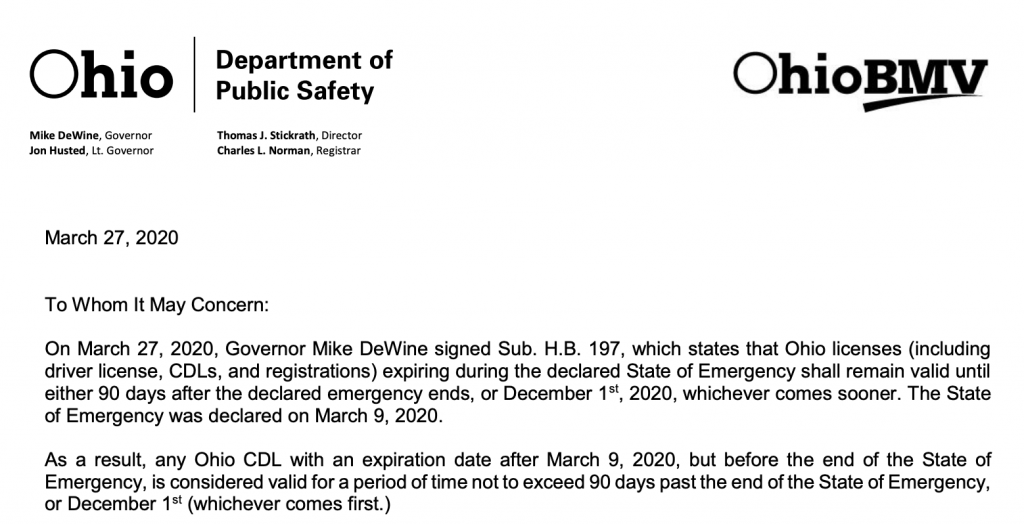

Ohio DOT CDL Expiration Extension Information

Any Ohio CDL with an expiration date after March 9, 2020, but before the end of the State of Emergency, is considered valid for a period of time not to exceed 90 days past the end of the State of Emergency, or December 1st (whichever comes first.) For the full letter click HERE.

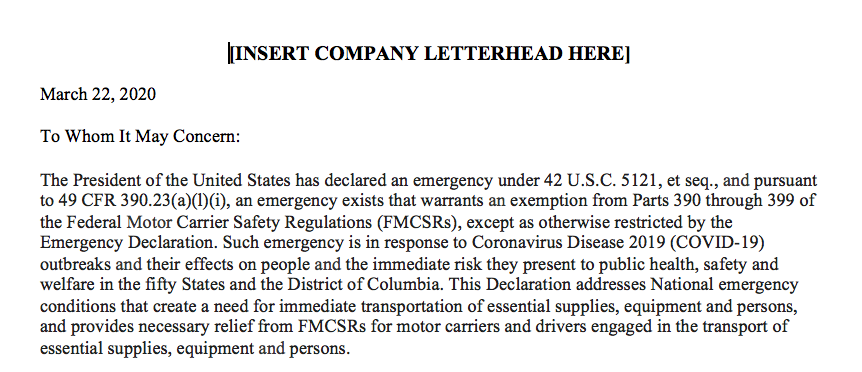

Essential Business Letter

Customize this optional letter, print and place in trucks.

Under Ohio’s stay at home order, credentialing is not required, but we have produced a template letter that you can customize and place in trucks to give your drivers peace of mind.

Download the full letter HERE.

Ohio Stay At Home Order Explained

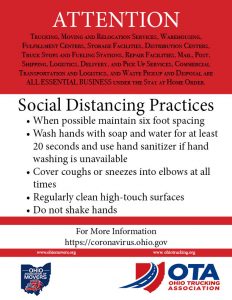

On March 22, 2020, the state of Ohio enacted a Stay at Home Order. This order limits the businesses that are aloud to operate at this time. Under this order the state identified a number of essential businesses that are allowed to still operate:

- Trucking, moving and relocation services

- Warehousing, fulfillment centers, storage facilities and distribution centers

- Highways, ports, railroads, taxis, transportation network provider sand public transportation

- Truck stops and fueling stations

- Repair facilities

- Mail, post, shipping, logistics, delivery, and pick up services

- Commercial transportation and logistics providers necessary for Essential Activities and other purposes

- Supply chain for critical products and industries

- Waste Pickup and Disposal

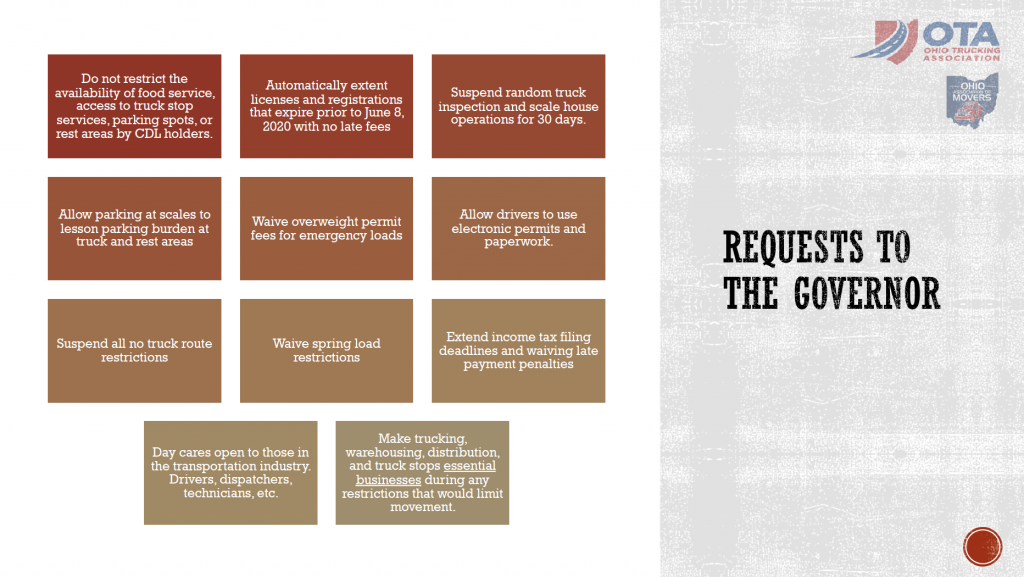

During this time, we are asking Governor DeWine to make the trucking Industry a priority. Here are our asks:

- Full Access to Rest Areas, Food Services and Parking for CDL Holders

- Extend Licenses and Registration That Expire Prior to June 8, 2020

- Suspend Random Truck Inspections and Scale Houses for 30 Days

- Allow Truck Parking at Scale Facilities

- Waive Overweight Permit Fees for Emergency Loads

- Allow Drivers to Use Electronic Permits and Paperwork

- Suspend all No Truck Route Restrictions and Waive Spring Load Restrictions

- Extend Income Tax Filing Deadline and Waive Late Penalties

- Keep Daycares Open to All Transportation Employees

- Make Trucking, Warehousing, Distribution and Truck Stops Essential Business

HB197 Summary

The Ohio Legislature and Governor's Office have worked together to ease regulatory burdens during this time. We are appreciative of the work being done by the state to ensure expiring CDL licenses continue to be valid and accepted until this historic time has passed. Click HERE for full summary.

Interim Guidance for Businesses and Employers to Plan and Respond to COVID-19

This interim guidance is based on what is currently known about the coronavirus disease 2019 (COVID-19). COVID-19 is a respiratory illness that can spread from person to person. The outbreak first started in China, but the virus continues to spread internationally and in the United States. The Centers for Disease Control and Prevention (CDC) will update this interim guidance as additional information becomes available. Click HERE for more information.

Print Out PUCO Hours of Service Exemption

Please note, your drivers MUST print this notice off and have it on them during this time if they are running special routes outside of normal HOS. Please note, The regulatory relief exempting motor carriers from hours-of-service requirements granted in this notice does not alter a motor carrier's duty to monitor its drivers; maintain records of duty status, and ensure drivers are not ill, fatigued, impaired, or otherwise unable to operate a commercial motor vehicle safely.

Blog Posts, Press Releases and Webinar Replays

May 28 Webinar Replay: Legal Impact of COVID-19

Listen as President Tom Balzer, along with Greg Melick and Alex Karcher of Luper Neidenthal & Logan, give an update on the state of the industry in Ohio amidst COVID-19. During this webinar, they will be talking about the changes in regulations, the issues facing member companies and the impact from a legal perspective. Click HERE for the replay. Click HERE for the PowerPoint presentation. Click HERE for a trucking-specific download from the CDC.

Listen as President Tom Balzer, along with Greg Melick and Alex Karcher of Luper Neidenthal & Logan, give an update on the state of the industry in Ohio amidst COVID-19. During this webinar, they will be talking about the changes in regulations, the issues facing member companies and the impact from a legal perspective. Click HERE for the replay. Click HERE for the PowerPoint presentation. Click HERE for a trucking-specific download from the CDC.

May 21 Webinar Replay: Impact of COVID-19 on Unemployment Compensation

Listen as President Tom Balzer gives you an update on the state of the industry in Ohio amidst COVID-19. During this webinar, he will be talking about the changes in regulations, the issues facing member companies and the impact on the unemployment compensation system. Click HERE for the replay.

Listen as President Tom Balzer gives you an update on the state of the industry in Ohio amidst COVID-19. During this webinar, he will be talking about the changes in regulations, the issues facing member companies and the impact on the unemployment compensation system. Click HERE for the replay.

May 18 Webinar Replay: OTA President Tom Balzer Talks COVID-19, State of Ohio Regulation Changes and Answers Your Questions

Listen as President Tom Balzer gives you an update on the state of the industry in Ohio amidst COVID-19. During this webinar, he will be talking about the changes in regulations, the issues facing member companies and how you can keep your drivers healthy on the road during this time. Click HERE for the replay.

Listen as President Tom Balzer gives you an update on the state of the industry in Ohio amidst COVID-19. During this webinar, he will be talking about the changes in regulations, the issues facing member companies and how you can keep your drivers healthy on the road during this time. Click HERE for the replay.

May 14 Webinar Replay: Impact of COVID-19 on the Agriculture Supply Chain

Listen as Tom Balzer, Adam Sharp Executive Vice President of Ohio Farm Bureau and Yvonne Lesicko, Vice President of Public Policy for Ohio Farm Bureau discuss the impacts of COVID-19 on agriculture and the impact the pandemic related closures are having on the food supply chain. Click HERE for the replay.

Listen as Tom Balzer, Adam Sharp Executive Vice President of Ohio Farm Bureau and Yvonne Lesicko, Vice President of Public Policy for Ohio Farm Bureau discuss the impacts of COVID-19 on agriculture and the impact the pandemic related closures are having on the food supply chain. Click HERE for the replay.

May 11 Webinar Replay: Equipping Employees to Return to the Workplace

Listen as Tom Balzer provides an update on the latest in the Governor's Responsible Restart Ohio plan and its impact on the industry. Join him is Ruth Bowdish from On Demand Drug Testing speaking about Employee Assistance Programs and how they can be utilized to reengage employees and equip them to return to work and navigate fears regarding COVID-19 as they come out of quarantine. Click HERE for the replay.

Listen as Tom Balzer provides an update on the latest in the Governor's Responsible Restart Ohio plan and its impact on the industry. Join him is Ruth Bowdish from On Demand Drug Testing speaking about Employee Assistance Programs and how they can be utilized to reengage employees and equip them to return to work and navigate fears regarding COVID-19 as they come out of quarantine. Click HERE for the replay.

May 7 Webinar Replay: Responsible Restart Ohio Update

Join Tom Balzer for an update on the latest in the Governor's Responsible Restart Ohio plan and its impact on the industry. At the end there will be 15 minutes for you to ask any questions you have about what is going on and what changes your business needs to take if being impacted by COVID-19. Click HERE for the replay.

Join Tom Balzer for an update on the latest in the Governor's Responsible Restart Ohio plan and its impact on the industry. At the end there will be 15 minutes for you to ask any questions you have about what is going on and what changes your business needs to take if being impacted by COVID-19. Click HERE for the replay.

May 4 Webinar Replay: COVID-19 and the Freight Market

Listen as Tom Balzer (Ohio Trucking Association), Bob Voltmann (Transportation Intermediaries Association), and Noël Perry (Transport Futures) discuss the freight market. Click HERE for the replay.

Listen as Tom Balzer (Ohio Trucking Association), Bob Voltmann (Transportation Intermediaries Association), and Noël Perry (Transport Futures) discuss the freight market. Click HERE for the replay.

April 30 Webinar Replay: Restarting the Ohio Economy

Watch a replay of President Tom Balzer and Representative Jon Cross (R-83) discussing the work of the OHIO 2020 Economic Recovery Task Force and the Ohio Legislature on restarting the economy. Click HERE for the replay.

Watch a replay of President Tom Balzer and Representative Jon Cross (R-83) discussing the work of the OHIO 2020 Economic Recovery Task Force and the Ohio Legislature on restarting the economy. Click HERE for the replay.

April 27 Webinar Replay: OTA President Tom Balzer Talks COVID-19, State of Ohio Regulation Changes

Watch a replay of President Tom Balzer giving an update on the state of the industry in Ohio amidst COVID-19. During this webinar, he will be talking about the changes in regulations, what he thinks Ohio's plans are to restart the economy, the issues facing member companies and how you can keep your drivers healthy on the road during this time. Click HERE for the replay.

Watch a replay of President Tom Balzer giving an update on the state of the industry in Ohio amidst COVID-19. During this webinar, he will be talking about the changes in regulations, what he thinks Ohio's plans are to restart the economy, the issues facing member companies and how you can keep your drivers healthy on the road during this time. Click HERE for the replay.

April 23 Webinar Replay: Restarting the Ohio Economy

April 23 Webinar Replay: Restarting the Ohio Economy

Watch a replay of President Tom Balzer and Lydia Mihalik, Director of the Development Services Agency, discuss what the state has available for business support during COVID-19 and to talk about how the state of Ohio enters into recovery. Click HERE for the replay.

April 20 Webinar Replay: OTA President Tom Balzer Talks COVID-19, State of Ohio Regulation Changes

April 20 Webinar Replay: OTA President Tom Balzer Talks COVID-19, State of Ohio Regulation Changes

Watch a replay of President Tom Balzer giving an update on the state of the industry in Ohio amidst COVID-19. During this webinar, he will be talking about the changes in regulations, what he thinks Ohio's plans are to restart the economy, the issues facing member companies and how you can keep your drivers healthy on the road during this time. Click HERE for the replay.

April 16 Webinar Replay: The Impact of COVID-19 on the Freight Market

April 16 Webinar Replay: The Impact of COVID-19 on the Freight Market

Watch a replay OTA President Tom Balzer and FTR Transportation Intelligence Trucking Vice President Avery Vise in this member only webinar. The presentation covers FTR's expectations for how COVID-19 will affect the economy and freight transportation in 2020, including the outlook for freight demand in key segments - dry van, refrigerated, and flatbed - and the potential impact on trucking capacity and utilization. Click HERE for the replay. CLICK HERE for the FTR Transportation Intelligence slide deck.

April 13 Webinar Replay: OTA President Tom Balzer Talks COVID-19, State of Ohio Regulation Changes

April 13 Webinar Replay: OTA President Tom Balzer Talks COVID-19, State of Ohio Regulation Changes

Watch a replay of President Tom Balzer's update on the state of the industry in Ohio amidst COVID-19. During this webinar, he talked about the changes in regulations, the issues facing member companies and how you can keep your drivers healthy on the road during this time. Click HERE for the replay.

April 9 Webinar Replay: OTA President Tom Balzer and ATA Economic Analyst Alan Karickhoff Talk COVID-19 Economic Impact

April 9 Webinar Replay: OTA President Tom Balzer and ATA Economic Analyst Alan Karickhoff Talk COVID-19 Economic Impact

Tune in as OTA President Tom Balzer and special guest ATA Economist Alan Karickhoff give you an update on the economic impact of COVID-19. At the end there will be 15 minutes for you to ask any questions you have about what is going on and what changes your business needs to take if being impacted by COVID-19. Click HERE for the replay.

FHWA to Allow Food Trucks to Operate at Interstate Rest Areas

The Federal Highway Administration (FHWA) issued a notice Friday, April 3, to the state departments of transportation, that the administration will allow food trucks to operate and sell food and beverages at federally funded interstate highway rest areas to support commercial truck drivers during the COVID-19 national emergency.

The Administration noted that state transportation agency partners recommended this action in order to assist drivers in getting meals. Many drivers have expressed difficultly in getting food due to widespread restaurant closures.

Current statute prohibits commercial activity in federally funded rest areas, with limited exceptions. The FHWA notice effectively suspends enforcement action at the state level, allowing the food trucks to operate at rest area locations until the National Emergency declaration is lifted. Read more HERE.

Poster to Download and Display

Emergency Funds Available for Small Businesses

Check out the Schneider Downs website for assistance with the new tax law, SBA loans or other business topics related to our current economic and health situation. Click HERE for articles by Schneider Downs.

April 2 Webinar Replay: Member-Exclusive Webinar: COVID-19 Legislation Explained

April 2 Webinar Replay: Member-Exclusive Webinar: COVID-19 Legislation Explained

In the wake of the coronavirus crisis, the President and US Congress have passed specific emergency legislation. Schneider Downs & Co. Inc. Tax shareholder, Carl Scharf, joined OTA President Tom Balzer to explain the $2 trillion Coronavirus Aid, Relief and Economic Security (CARES) Act, and more specifically the Paycheck Protection Program and income tax provisions impacting the trucking industry. Click HERE for the replay. Download Schneider Downs Slides HERE

Ohio Department of Insurance FAQs For Health Insurance Coverage

A breakdown of information regarding health insurance coverage for Ohio employees. Click HERE for FAQs.

CDC Statement on Self-Quarantine Guidance for Greater New York City Transportation and Delivery Workers

When we issued the self-quarantining guidance for greater New York City residents leaving this area, it was out of an abundance of caution to help protect U.S. areas with lower levels of COVID-19 spread. In line with our recommendations for other essential critical infrastructure workers, this guidance does not apply to critical transportation and delivery workers who are desperately needed for New York residents to continue their daily lives and respond to the COVID-19 outbreak. Read more HERE.

Ohio Overweight Permitting Information

For this emergency ODOT is currently allowing permits for emergency medical relief, food and like items to be issued via phone with following the paper process and fee collection at a later time. Ohio Administrative Code sections 5501:2-1-01 (H)(I), 5501:2-1-06 and 5501:2-1-07 (12) Emergency single trip permit shall not exceed one calendar day; (13) Emergency single trip and return permit shall not exceed three calendar days. In no case shall a permit be issued for a duration which extends beyond the expiration date of any insurance policy or endorsement provided as evidence of financial responsibility. Click Here for more information.

Ohio BMV Locations Remaining Open for CDL Exams and Renewals

Ohio Governor Mike DeWine announced that five BMV offices in Ohio will remain open for Commercial Drivers License (CDL) renewals and to perform commercial knowledge exams.

The locations to be opened are as follows:

Central Ohio: Registrar Office—4740 Cemetery Road, Columbus 43026 / Exam Station—4738 Cemetery Road, Hilliard 43026

NW Ohio: Registrar Office and Exam Station—1616 E. Wooster St., Bowling Green 43042

NE Ohio: Registrar Office — 7000 Biddulph Road, Brooklyn 44144

SW Ohio: Registrar Office—10938 Hamilton Ave., Mt. Healthy 45231 / Exam Station—10940 Hamilton Ave., Mt. Healthy 45231

SE Ohio: Registrar Office and Exam Station—142 Gross St., Marietta 45750

*note: as of March 23, the Registrar Office and Exam Station in Bedford is CLOSED.

For the full declaration: BMV Closures Press Release

Inquiries and further updates can be found at the Ohio BMV website HERE.

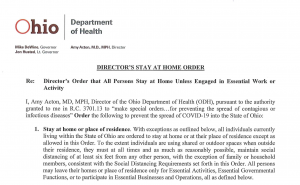

Ohio Issues Stay at Home Order

The Director of the Ohio Department of Health, Amy Acton, MD, MPH, has officially put in place a Stay at Home Order that will begin March 23 at 11:59 pm. The order requires all people to stay at home, except for individuals that are exempt based on the details of the order. Full details can be found HERE. Do you still have questions about the order? Find answers to the Frequently Asked Questions HERE.

CDC Guidelines and Symptoms

The following symptoms may appear 2-14 days after exposure.

The following symptoms may appear 2-14 days after exposure.

- Fever

- Cough

- Shortness of breath

If you think you are sick, or if you are needing more information, please read the recommendations put forward by the CDC HERE.

Disaster Loan Assistance for Small Businesses

Governor DeWine on Thursday announced that the U.S. Small Business Administration (SBA) has qualified the State of Ohio for the Economic Injury Disaster Loan Program. Under the program, businesses and non-profits economically impacted as a result of the COVID-19 outbreak may apply for a low-interest loan of up to $2 million to help pay for fixed debts, payroll, accounts payable and other bills. Apply for the loan HERE.

DoD Suspends Military Moves

All DoD military personnel will stop movement while this memorandum is in effect. In addition, DoD civilian personnel and DoD family members, whose transportation is government-funded, will also stop movement. This policy applies to Permanent Change of Station (PCS) and Temporary Duty. Read details HERE.

Ohio Bureau of Workers Compensation Deferral

Ohio’s Bureau of Workers' Compensation (BWC) system is the exclusive provider of workers’ compensation insurance in Ohio and serves 249,000 public and private employers.

To help businesses facing difficulties due to the COVID-19 pandemic, the Ohio BWC is announcing that insurance premium installment payments due for March, April, and May for the current policy year may be deferred until June 1, 2020. At that time the matter will be reconsidered.

"BWC will not cancel coverage or assess penalties for amounts not paid because of the coronavirus pandemic," said Lt. Governor Husted. "Installment payments due for the three-month period are totaled at approximately $200 million, and that money will now stay in the economy."

For more information, visit www.bwc.ohio.gov.

Grace Period for Health Insurance Premiums

All health insurers are required to provide the option of deferring premium payments, interest free, for up to 60 calendar days from eachoriginal premium due date. This means that employers can defer their premium payments up to two months, giving them some relief on costs, while keeping their employees insured. Read details HERE.

Federal IRS Tax Day now July 15

Businesses who need additional time must file Form 7004

IR-2020-58, March 21, 2020

WASHINGTON — The Treasury Department and Internal Revenue Service announced today that the federal income tax filing due date is automatically extended from April 15, 2020, to July 15, 2020.

Taxpayers can also defer federal income tax payments due on April 15, 2020, to July 15, 2020, without penalties and interest, regardless of the amount owed. This deferment applies to all taxpayers, including individuals, trusts and estates, corporations and other non-corporate tax filers as well as those who pay self-employment tax.

Taxpayers do not need to file any additional forms or call the IRS to qualify for this automatic federal tax filing and payment relief. Individual taxpayers who need additional time to file beyond the July 15 deadline, can request a filing extension by filing Form 4868 through their tax professional, tax software or using the Free File link on IRS.gov. Businesses who need additional time must file Form 7004.

CLICK HERE for full news release. CLICK HERE for IRS Coronavirus Tax Relief Page.

UPDATED: Rest Areas and Truck Parking in Pennsylvania Reopened

The Pennsylvania Turnpike Authority announced the reopening of restrooms and food carry-out options at the 17 Service Plazas along the Turnpike, starting Friday morning at 7:00 am.

Restrooms will be open 24 hours a day, while the food available for carry-out will be available from 7 am until 6 pm, except at the North Midway and Valley Forge plazas, which will offer food 24 hours a day.

Tolls will continue to be collected exclusively with EZ-Pass, or, for those vehicles that don’t have EZ-Pass, a Toll-by-Plate billing method will be used. The standard tolling rates will apply, with no surcharges added. Inquiries and further updates can be found at the Turnpike website HERE.

Pilot Flying J Updates Which Centers are Open Around the Country

A note from Pilot Flying J: Thank you and your drivers for continuing to deliver the goods we need, especially in challenging times when they are needed most. We are here to serve you and keep you moving. Our number one priority is protecting the safety of our team members and guests. We developed a response task force in February to monitor COVID-19 (coronavirus) and have been meeting daily to monitor and update our plans to best respond to the rapidly changing situation. Click HERE for full list of services.

IRP Extension

Governor DeWine has declared a state of emergency, so until further notice all International Registration Plan (IRP) jurisdictions and enforcement personnel will refrain from taking enforcement action on vehicles barring Ohio IRP Vehicle Registrations (IRP Cab Card or IRP Temporary Authorization Authority [TA]) that have expiration dates on or after March 18, 2020. We recommend you print off and carry the letter with you. Click HERE for more information and the letter.

U.S. Small Business Administration Relief

The U.S. Small Business Administration is offering designated states and territories low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of the Coronavirus (COVID-19). Click HERE for more information.

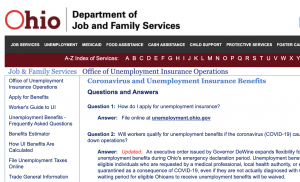

Governor DeWine Issues Unemployment Declaration

An executive order issued by Governor DeWine expands flexibility for Ohioans to receive unemployment benefits during Ohio's emergency declaration period. Unemployment benefits will be available for eligible individuals who are requested by a medical professional, local health authority, or employer to be isolated or quarantined as a consequence of COVID-19, even if they are not actually diagnosed with COVID-19. In addition, the waiting period for eligible Ohioans to receive unemployment benefits will be waived. Click HERE for more information.

Ohio Chamber of Commerce Resource Page

As a resource for you, the Ohio Chamber of Commerce has launched COVID-19 Business Resources webpage. The new webpage is designed to be a central hub for Ohio business owners to view current temporary restrictions, available resources to help curb the COVID-19 impact on your business, and pending legislation addressing COVID-19 and aiming to provide additional relief to businesses. Click HERE for the resource page.

For the latest information regarding COVID-19 in Ohio go HERE.